Investment returns of the average investor — What happens when you don’t stay the course.

10 April 2015

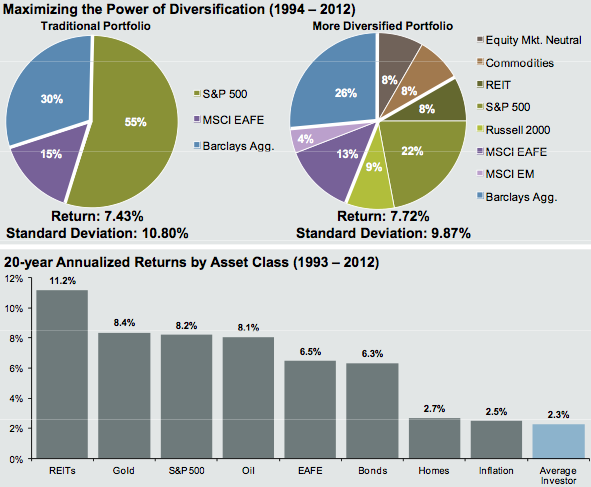

In my book, Money for Something we discuss how important it is to “stay the course.” Most people, however, don’t stay the course, and this chart from the J.P. Morgan Guide to the Markets illustrates the astounding consequences.

Truly incredible—During the 20 years between 1993 and 2012, the annualized returns of the asset classes in which we typical invest varied between 6.3% and 11.2%. But the return actually realized by the average investor was a meager 2.3%—not even beating inflation.

Why does this happen? The reasons are many:

- Investors often pay high fees. A mutual fund charging 2.5% will cut your long-term returns in half. Terrible, especially when you consider there are ultra low-cost alternatives available, from companies like Vanguard, which have fees as low as 0.05%.

- Investors make emotional decisions. So many investors exit the market during crashes. A successful investor doesn't panic during crashes, nor does he become euphoric during bull markets. With discipline and without emotion, he just continues with his strategy.

- Investors chase performance. Investors are constantly jumping from one strategy to another, from one fund to another, always chasing last-years winners—which, in the long-run, is a losing strategy.

Success in long-term investing is easy, but you have to have discipline, and you have to stay the course.

Enjoy this article? — You can find similar content via the category and tag links below.

Questions or comments? — Feel free to email me using the contact form below, or reach out on Twitter.